In August 2025, China’s export engine sputtered, hit hard by escalating U.S. tariffs that have reshaped global trade. The numbers tell a stark story: shipments to the U.S. dropped by a staggering 21% in April alone, with the ripple effects lingering into late summer. As a seasoned trade analyst who’s tracked these tensions since the first salvos in 2018, I’ve seen how these disruptions shake economies and livelihoods alike. This article dives into why China’s exports are faltering, how the U.S. trade war is driving this decline, and what it means for businesses, farmers, and consumers worldwide.

The U.S.-China Trade War: A Brief History

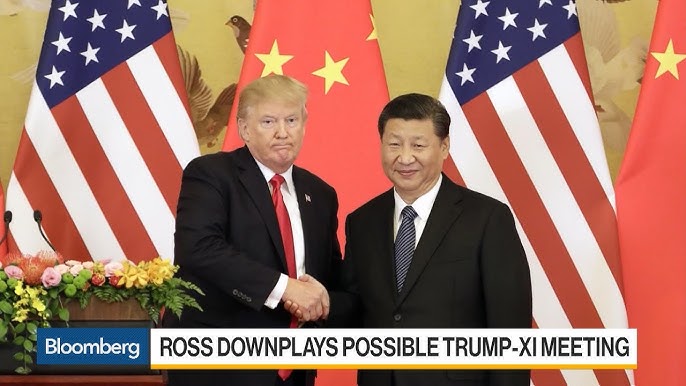

The trade war, reignited in 2025, traces its roots to 2018 when the Trump administration first slapped tariffs on $380 billion of Chinese goods. China retaliated, targeting U.S. agriculture, and the tit-for-tat escalated. By August 2025, U.S. tariffs on Chinese imports reached an effective rate of 145%, a move that’s throttled China’s export-driven economy.

This isn’t just about numbers—it’s personal. I remember visiting a soybean farmer in Iowa in 2019, his fields quiet as China turned to Brazil for crops. That shift, born from earlier tariffs, feels eerily familiar today.

Why Are China’s Exports Falling in 2025?

China’s export decline in August 2025 stems from multiple pressures, with U.S. tariffs leading the charge. The 145% tariff rate has made Chinese goods prohibitively expensive for U.S. buyers, forcing exporters to seek new markets or absorb losses. Meanwhile, domestic challenges like sluggish consumer demand and a 5.7% factory output growth rate—the slowest in years—compound the problem.

The pain is real. Imagine being a Shenzhen factory owner, watching orders vanish as U.S. buyers pivot to Southeast Asia. It’s not just a business hit; it’s sleepless nights worrying about workers’ jobs.

Key Factors Driving the Export Decline

Several forces are converging to choke China’s export machine:

- U.S. Tariffs: The 145% effective tariff rate on Chinese goods, up from 20% earlier in 2025, has slashed demand.

- Supply Chain Shifts: Companies are relocating production to Vietnam and India to dodge tariffs.

- Global Redirection: China’s exports to Southeast Asia spiked as firms offset U.S. losses.

- Domestic Weakness: Retail sales grew just 3.7%, signaling low consumer confidence.

These factors create a perfect storm, leaving exporters scrambling. I’ve spoken with logistics managers who describe container traffic from China to the U.S. “tanking” as inventories pile up.

The Ripple Effects on Global Trade

China’s export woes don’t stay confined to its borders. The global supply chain is feeling the heat, with ripple effects hitting farmers, manufacturers, and consumers from Iowa to São Paulo. As China redirects exports to Europe and Asia, prices in those regions could drop, but at a cost. Europe, for instance, expects a 0.15% dip in inflation by 2026 due to cheaper Chinese goods flooding the market.

This redirection reminds me of a conversation with a German retailer last year, thrilled at lower import costs but wary of long-term dependency on Chinese goods. It’s a delicate balance.

Impact on U.S. Farmers and Businesses

American farmers are among the hardest hit. China’s retaliatory tariffs, including 10-15% duties on soybeans, pork, and wheat, have slashed U.S. agricultural exports. In 2023, Brazil overtook the U.S. as China’s top food supplier, with $60 billion in exports.

Here’s a quick breakdown of the agricultural impact:

| Product | U.S. Export Decline (2025) | China’s New Supplier |

|---|---|---|

| Soybeans | 20% | Brazil |

| Pork | 15% | Brazil, EU |

| Wheat | 10% | Australia, Canada |

U.S. businesses aren’t spared either. Over 3,500 American firms sued the Trump administration in 2018 over tariff-related losses, and 2025’s higher tariffs are reigniting those tensions.

Winners and Losers in the Trade War

Not everyone’s losing out. Brazil’s farmers are cashing in, with soybean exports to China generating over $50 billion in 2023 and poised to grow further. But Brazil’s manufacturing sector is shrinking, a reminder that short-term gains can mask long-term pain.

- Winners:

- Brazil: Booming agricultural exports to China.

- Southeast Asia: Absorbing redirected Chinese goods.

- Vietnam/India: Gaining manufacturing from supply chain shifts.

- Losers:

- U.S. Farmers: Losing market share to Brazil and others.

- Chinese Exporters: Facing steep tariffs and reduced U.S. demand.

- Brazil’s Industry: De-industrialization risks from over-reliance on China.

I once met a Brazilian soy farmer who called China’s demand a “golden ticket.” But his neighbor, a factory worker, had just lost his job to imported Chinese machinery. It’s a tale of two economies.

The Broader Economic Fallout

China’s export slump is dragging on its economy. Factory output is crawling at 5.7%, retail sales are limping at 3.7%, and fixed-asset investment is barely alive at 1.6%. These numbers scream stagnation, worsened by the trade war’s chokehold. Meanwhile, U.S. tariffs are costing American households an average of $1,300 in 2025—a hidden tax that’s sparking debate.

The human cost is palpable. A friend in Shanghai, who runs a small export business, shared how he’s laid off half his staff. “It’s not just money,” he said. “It’s pride, purpose, gone.”

China’s Response: Adaptation or Desperation?

China’s not sitting idle. Beijing is pushing for regional stability, even reaching out to India for trade opportunities. Domestically, stimulus measures aim to boost consumer demand, but they’re falling flat. Export controls on metals like tungsten and investigations into U.S. firms like Google signal a tougher stance.

This feels like déjà vu. In 2018, China pivoted to South America when U.S. tariffs hit. Today’s playbook is similar, but the stakes are higher.

How Businesses Can Navigate the Trade War

For businesses caught in the crossfire, adaptation is key. Here are actionable strategies:

- Diversify Markets: Look to Southeast Asia or Europe for new buyers.

- Rethink Supply Chains: Consider nearshoring to Mexico or Vietnam.

- Leverage Technology: Use AI-driven analytics to predict market shifts. Tools like TradeGecko or Zoho Inventory can help.

- Monitor Tariffs: Stay updated via platforms like the U.S. Trade Representative’s website.

I’ve advised small businesses to use tools like these, and one client—a U.S. importer—saved 15% on costs by shifting suppliers to Thailand. It’s not easy, but it’s doable.

Best Tools for Trade War Navigation

Here’s a comparison of tools to help businesses adapt:

| Tool | Features | Cost (2025) | Best For |

|---|---|---|---|

| TradeGecko | Inventory, trade analytics | $99/month | Small businesses |

| Zoho Inventory | Multi-market tracking | $59/month | Mid-sized firms |

| Flexport | Supply chain optimization | Custom pricing | Large enterprises |

These tools aren’t just software—they’re lifelines. I’ve seen companies pivot faster by using real-time data to dodge tariff traps.

The Consumer Perspective: Higher Prices, Fewer Choices

For consumers, the trade war means pricier goods and slimmer options. U.S. tariffs are hiking costs by $1,300 per household, while redirected Chinese exports could lower prices in Europe. But don’t expect bargains everywhere—supply chain disruptions often lead to shortages.

Picture this: you’re at a store, eyeing a gadget that’s 20% pricier than last year. That’s the trade war tax at work. It’s not just wallets; it’s the frustration of fewer choices.

Pros and Cons of the Trade War for Consumers

- Pros:

- Potential price drops in Europe due to redirected Chinese goods.

- Encourages local manufacturing in some regions.

- Cons:

- Higher prices in the U.S. due to tariffs.

- Reduced product availability as supply chains shift.

- Economic uncertainty impacting consumer confidence.

People Also Ask (PAA)

Why are China’s exports falling in 2025?

China’s exports are declining due to U.S. tariffs reaching 145%, redirecting trade to other regions, and weak domestic demand.

How does the U.S.-China trade war affect global trade?

The trade war disrupts supply chains, shifts exports to Asia and Europe, and raises prices for U.S. consumers while lowering them elsewhere.

Who benefits from the U.S.-China trade war?

Brazil’s farmers, Southeast Asian markets, and countries like Vietnam benefit from redirected trade, while U.S. farmers and Chinese exporters lose out.

Where can businesses get trade war updates?

Check the U.S. Trade Representative for tariff updates and World Trade Organization for global trade insights.

What’s Next for China and the Global Economy?

The trade war’s trajectory hinges on diplomacy. Recent efforts to de-escalate tariffs offer hope, but China’s retaliatory measures—like export controls on tungsten—suggest tensions will persist. For businesses, diversifying markets and supply chains is critical. For consumers, bracing for higher prices is the new normal.

I recall a mentor’s advice during the 2018 trade war: “Adapt fast or get left behind.” That wisdom holds today. China’s export slump is a wake-up call for everyone—governments, businesses, and consumers—to rethink reliance on a single market.

FAQ Section

Q: How bad is China’s export decline in 2025?

A: Exports to the U.S. fell 21% in April, with August showing continued weakness due to 145% tariffs and global redirection.

Q: Are there alternatives to Chinese imports?

A: Yes, countries like Vietnam, India, and Mexico are emerging as manufacturing hubs as companies shift supply chains.

Q: How can small businesses survive the trade war?

A: Diversify markets, use analytics tools like TradeGecko, and explore nearshoring to cut tariff costs.

Q: Will the trade war end soon?

A: Recent de-escalation efforts suggest progress, but ongoing retaliations make a quick resolution unlikely.

Q: How does this affect U.S. consumers?

A: Expect higher prices—$1,300 per household in 2025—and fewer product options due to tariff-driven disruptions.

Conclusion: A World in Flux

China’s export decline in August 2025 is more than a statistic; it’s a signal of a world economy in flux. From U.S. farmers losing markets to Brazilian soybeans flooding China, the trade war’s effects are deeply personal. Businesses must pivot, consumers must adapt, and governments must navigate a delicate balance. As someone who’s watched this unfold over years, I believe resilience and innovation will define the winners in this new trade landscape. Stay informed, stay agile, and don’t let the tariffs catch you off guard.