The global economy in 2025 is a wild ride, shaped by trade policies and tariffs that ripple across borders like a stone skipped across a pond. I remember sitting at my kitchen table last spring, sipping coffee and reading about the latest tariff hikes, wondering how they’d hit my wallet. From cars to clothing, prices seemed to creep up overnight. This article dives deep into the world of trade and tariffs, exploring their impact on the global economy in 2025 with a human touch, grounded in research, and packed with insights to help you understand what’s happening and why it matters.

What Are Tariffs and Why Do They Matter in 2025?

Tariffs are taxes slapped on imported goods, and in 2025, they’re a bigger deal than ever. They’re like a toll booth on the global trade highway, raising costs for businesses and consumers alike. This year, tariffs have surged to levels not seen since the Great Depression, reshaping economies worldwide.

The Role of Tariffs in Modern Trade

Tariffs protect domestic industries by making foreign goods pricier, but they also spark retaliation and trade wars. In 2025, they’re a tool for economic and political leverage, with countries like the U.S. using them to address trade deficits and national security concerns.

Why 2025 Is a Turning Point

This year, the U.S. average tariff rate jumped from 2.5% to an estimated 18.6% by August, driven by policies like the 25% tariffs on Canada and Mexico and a 30% tariff on Chinese imports. These shifts are reshaping global supply chains and consumer prices.

The U.S. Tariff Surge: A Game-Changer for Global Trade

The U.S., under President Trump’s second term, has unleashed a tariff blitz, targeting everything from steel to cars. These policies, rooted in the “America First” agenda, aim to boost domestic manufacturing but come with hefty consequences.

Key Tariff Policies in 2025

- IEEPA Tariffs: On February 4, 2025, 25% tariffs hit Canada and Mexico, and 10% tariffs targeted China, citing fentanyl and border security concerns. These later climbed to 30% for China.

- Sector-Specific Tariffs: Steel, aluminum, and auto tariffs rose to 25–50%, affecting global supply chains.

- Reciprocal Tariffs: A 10% baseline tariff on over 50 countries, with higher rates for nations like India (25%) and Brazil (40%), took effect April 2.

Economic Impact on the U.S.

These tariffs are a double-edged sword. They’ve boosted federal revenue to $29.6 billion in July alone, potentially covering 1.6% of GDP. But they’ve also raised consumer prices by 2.3%, costing households an average of $3,800 annually.

Global Ripple Effects: How Tariffs Are Reshaping Economies

Tariffs don’t stop at borders—they send shockwaves worldwide. I recall chatting with a friend in Canada who grumbled about higher grocery prices, blaming U.S. tariffs. Here’s how the world is feeling the heat in 2025.

Canada and Mexico: Bearing the Brunt

Canada’s economy is 2.1% smaller due to U.S. tariffs, while Mexico’s is slightly larger, thanks to USMCA exemptions. Retaliation from Canada has hit U.S. exports, creating a tense trade standoff.

China’s Economic Squeeze

China’s economy contracted by 0.2% long-term, with U.S. imports from China plummeting 64%. A temporary tariff pause offers hope, but a potential 125% hike looms.

Europe’s Balancing Act

The EU faces a 30% tariff threat, but no retaliation yet, keeping growth at a modest 0.9% annualized rate. The UK enjoys a slight 0.2% economic boost, navigating the storm better than most.

Emerging Markets: Mixed Outcomes

Brazil’s GDP could shrink by 0.6–1% if 40% tariffs persist, though export diversification might soften the blow. Fiji, surprisingly, sees potential benefits from cheaper goods flooding the Pacific.

The Pros and Cons of Tariffs in 2025

Tariffs are a hot topic, sparking debates from boardrooms to dinner tables. Here’s a breakdown of their upsides and downsides.

Pros of Tariffs

- Protect Domestic Jobs: Shield industries like steel and autos, preserving U.S. manufacturing jobs.

- Boost Government Revenue: Tariff income hit $350 billion annually, funding public projects.

- Leverage for Negotiations: Push trading partners to lower their own barriers, as seen with the Philippines’ trade deal.

Cons of Tariffs

- Higher Consumer Prices: Cars, coffee, and clothing costs are soaring, with consumers bearing 22% of tariff costs.

- Retaliation Risks: China’s tariffs on U.S. exports hurt farmers and manufacturers.

- Economic Slowdown: U.S. GDP growth is down 0.9% in 2025, with global trade fracturing.

Comparing Tariff Impacts Across Countries

| Country | Tariff Rate (2025) | Economic Impact | Retaliation Status |

|---|---|---|---|

| Canada | 25% | -2.1% GDP long-term | Retaliated |

| Mexico | 25% | Slightly larger economy | Limited retaliation |

| China | 30% | -0.2% GDP long-term | Retaliated |

| EU | 30% (proposed) | 0.9% growth rate, no major loss yet | No retaliation |

| Brazil | 40% | -0.6% to -1% GDP potential | Under consideration |

| Fiji | None | Potential benefit from cheaper goods | None |

This table shows how tariffs hit harder in some places than others, with Canada feeling the pinch most acutely.

The Human Cost: Stories from the Ground

Tariffs aren’t just numbers—they change lives. Take Maria, a small-business owner in Ohio who runs an auto parts shop. She told me her supplier costs spiked 20% this year, forcing her to raise prices and lose customers. Across the border, my Canadian friend, a farmer, struggles to export wheat due to retaliatory tariffs. These stories highlight the real-world stakes of trade policies.

Inflation and Everyday Life

With consumer prices up 2.3%, essentials like coffee and clothing are pricier. Families are tightening budgets, and small businesses like Maria’s are caught in the crossfire.

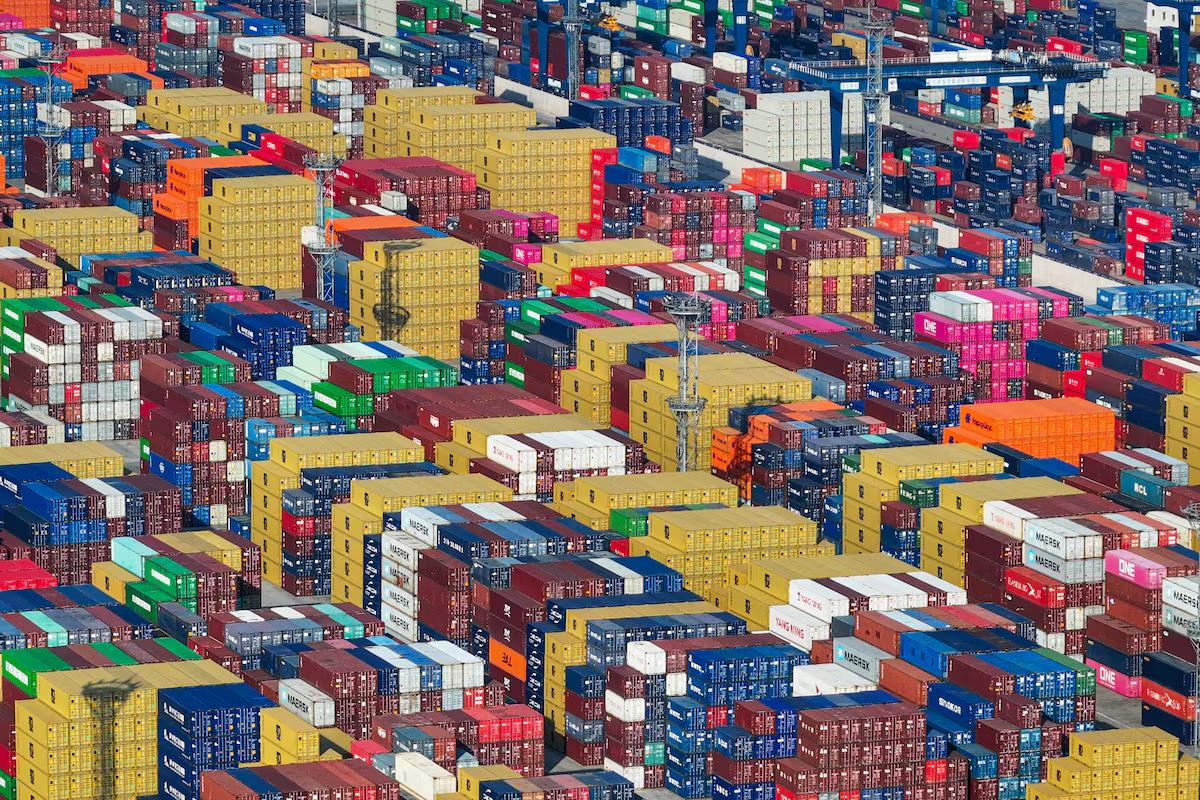

Supply Chain Disruptions

Global supply chains are rerouting, with companies shifting production to avoid tariffs. This means delays and higher costs for everything from electronics to groceries.

Navigating Trade in 2025: Tools and Strategies

For businesses and consumers, adapting to this tariff-heavy world is key. Here are practical ways to stay ahead.

Best Tools for Trade Analysis

- TradeMap: Offers real-time trade data to track tariff impacts. Visit trademap.org for insights.

- Bloomberg Terminal: Provides market analysis for tariff-affected sectors. Check bloomberg.com for subscriptions.

- WTO Tariff Analysis: Free tool for comparing global tariff rates at wto.org.

Strategies for Businesses

- Diversify Supply Chains: Source from tariff-exempt countries like Mexico under USMCA.

- Negotiate Trade Deals: Follow the Philippines’ example to secure lower rates.

- Pass Costs Wisely: Balance price hikes with discounts to retain customers.

People Also Ask (PAA) Section

What are the effects of tariffs on the global economy in 2025?

Tariffs have raised U.S. consumer prices by 2.3%, reduced GDP growth by 0.9%, and sparked retaliation, shrinking Canada’s economy by 2.1% and China’s by 0.2%. They’ve also boosted U.S. revenue but fractured global trade.

How do Trump’s tariffs impact U.S. consumers?

U.S. consumers face higher prices for cars, coffee, and clothing, with an average household cost of $3,800 annually. About 22% of tariff costs fall on consumers, with businesses absorbing 64%.

Are there any benefits to tariffs in 2025?

Yes, tariffs protect U.S. jobs in steel and autos, generate $350 billion in annual revenue, and pressure trading partners to lower barriers, as seen with the Philippines.

How can businesses adapt to new tariffs?

Businesses can diversify supply chains, use trade analysis tools like TradeMap, and negotiate deals to minimize tariff impacts while balancing price increases.

The Bigger Picture: Trade Wars and Global Stability

Tariffs in 2025 aren’t just about economics—they’re reshaping geopolitics. The U.S. suspension of WTO funding signals a shift away from multilateral trade systems, worrying leaders like Singapore’s Prime Minister, who warned of a fractured global economy.

The Risk of a Global Trade War

Fiji’s leaders fear being caught in a broader trade war, though they see short-term gains from cheaper goods. If tariffs escalate, global trust and growth could erode further.

A Path to Stability?

Negotiation is key. The U.S.-China 60-day tariff pause and trade frameworks with the UK and Philippines show diplomacy can work. Long-term, reducing non-tariff barriers could ease tensions.

FAQ Section

Why did tariffs increase so much in 2025?

President Trump’s policies, including IEEPA tariffs and reciprocal tariffs, aim to address trade deficits and protect U.S. industries, pushing rates to 18.6%.

How do tariffs affect small businesses?

Small businesses face higher input costs, like Maria’s auto parts shop, forcing price hikes or reduced margins, with some losing customers to cheaper alternatives.

Can consumers avoid tariff-driven price increases?

Consumers can shop for domestically made goods or buy from tariff-exempt countries, though options are limited as global prices rise.

What’s the long-term outlook for tariffs?

If IEEPA tariffs are ruled unlawful, rates could drop to 5%, boosting growth. Otherwise, persistent high tariffs may shrink global GDP further.

Are tariffs worth the economic cost?

It depends. They protect jobs and raise revenue but hurt consumers and global trade. The net effect hinges on negotiation outcomes and retaliation.

Looking Ahead: What’s Next for Trade and Tariffs?

As I write this, I’m staring at a news alert about a potential U.S.-China trade deal. It’s a reminder that 2025 is a pivotal year. Tariffs have brought short-term gains for U.S. revenue and jobs but at the cost of higher prices and global tension. For consumers, businesses, and policymakers, staying informed and adaptable is crucial. Check resources like WTO for updates, and consider tools like TradeMap to navigate this complex landscape. The global economy is at a crossroads—will it fracture or find balance? Only time will tell.